The redeemable preference shares of 10169 pence nominal value each. The closing mid-market price of 438 pence per Existing Ordinary Share in issue on Monday 4 April 2022 being the last practicable date prior to the publication of the Circular as adjusted for the 2021 final dividend of 1470 pence per Existing Ordinary Share for which the record date is Friday 8.

Jpaugh If I am a class consumer I follow contracts set by the class creator.

. A share denotes a claim on a corporations ownership or interest in a financial asset. Stockholders have a certain amount of say in how the company is run and are allowed to vote on important decisions such. In laymans terms the basic difference between basic EPS Basic EPS Basic EPS represents the income of the company for each common stock.

In other words EPS assesses the ability of a company to generate net profits for the common shareholders. However it is not necessary that the company will distribute the entire. They are also part owners of the company but they do not get any voting rights to select its management.

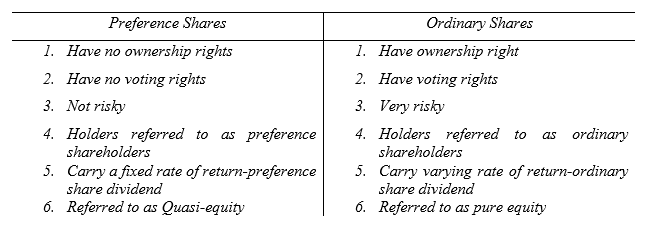

ORMapper but the fact remains that string is a lexical construct of the C grammar whereas SystemString is just a type. Shares are commonly divided into two types known as ordinary shares and preference shares. The shares are movable property which.

The holder of the equity shares are the real owners of the company ie. If a property is string my contract is. Ordinary shares provide a small degree of ownership in the issuing company.

Regardless of any explicit difference mentioned in any spec there is still this implicit difference that could be accomodated with some ambiguity. Equity shares are the ordinary shares of the company. For each Royal Dutch ordinary share held in bearer or Hague registry form tendered.

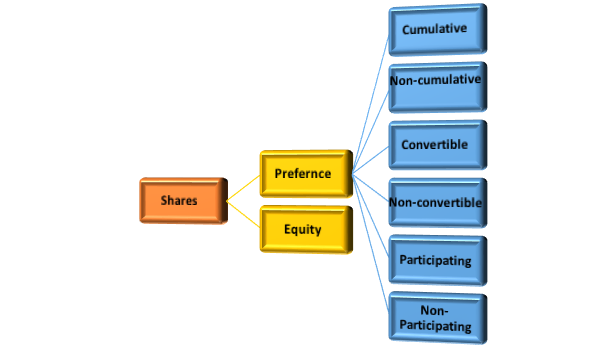

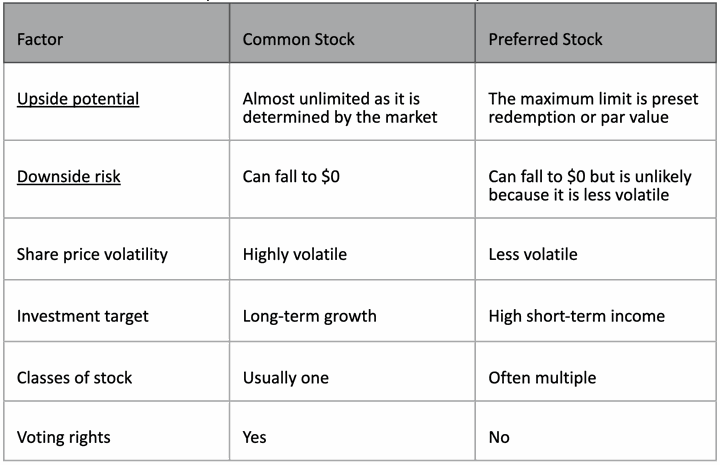

Differences Between Common and Preferred Stock. Ordinary Shares Preference Shares Bonus Shares Sweat Equity and Employee Stock Options ESOPs. The amount of shares held by them is the portion of their ownership in the company.

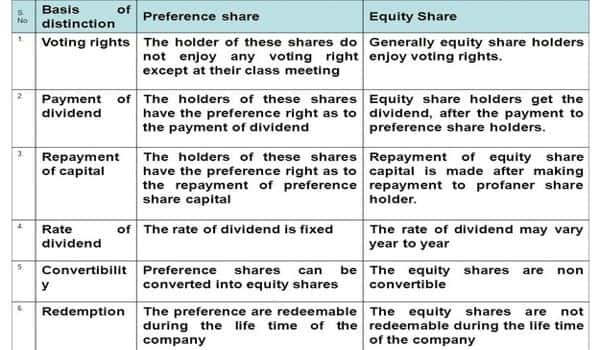

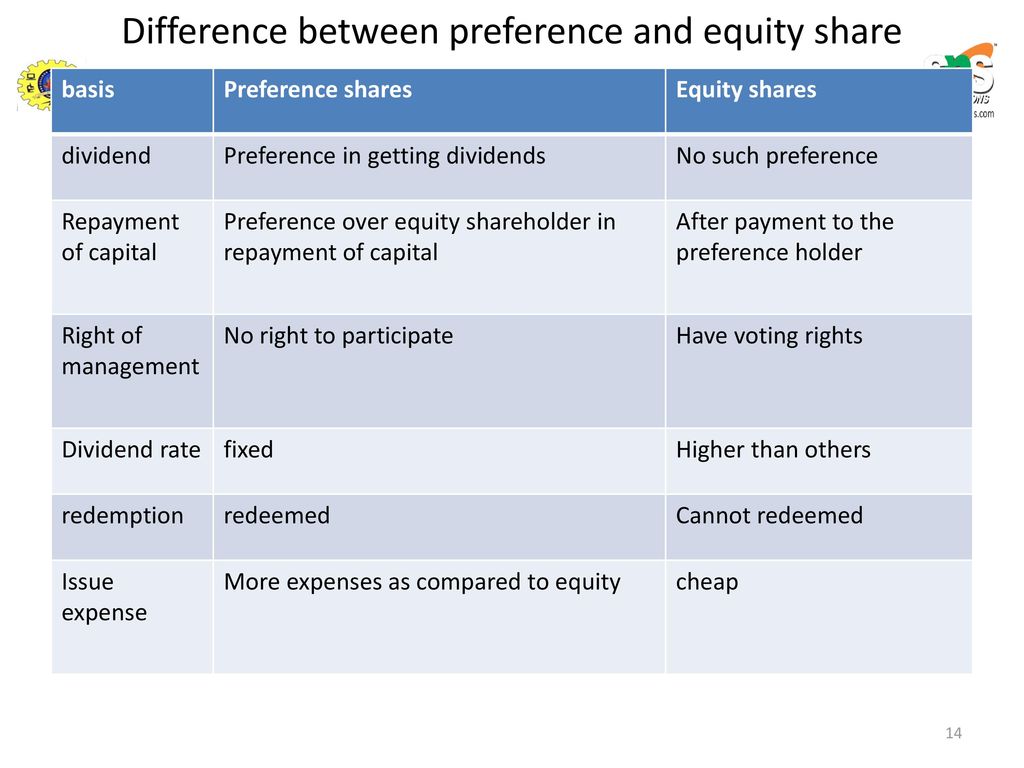

Ordinary shares and Preference shares are distinguished from each other based on the benefits rights and features that they offer to the holders of such shares. 0287333066 Royal Dutch Shell Class B ordinary shares. Government Bonds Corporate Bonds Municipal Bonds and Asset-Backed Securities.

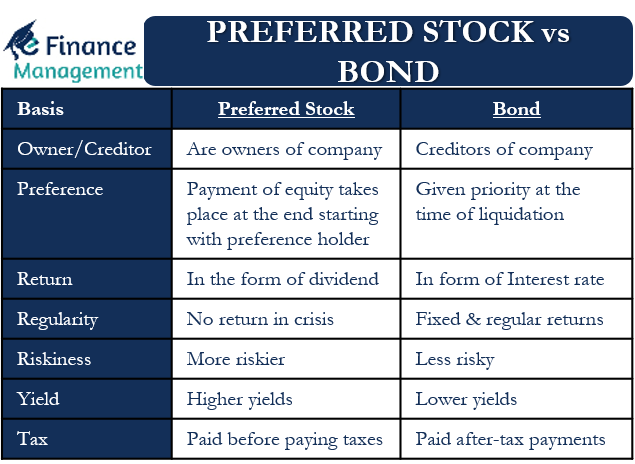

Class A shareholders generally have. In other words it is the value appreciation of the common shares resulting from equal distribution of the companys profit as dividends among the common stockholders. Following are the critical differences between equities vs bonds.

They are entitled to a fixed rate of. 2 Royal Dutch Shell Class A ordinary shares. Difference Between Bond and Equity.

The key difference between Common and Preferred Stock is that Common stock represents the share in the ownership position of the company which gives right to receive the profit share that is termed as dividend and right to vote and participate in the general meetings of the company whereas Preferred stock is the share. Preference Shareholders have the first right to receive dividends even before equity shareholders. The difference between Class A shares and Class B shares of a companys stock usually comes down to the number of voting rights assigned to the shareholder.

A share is defined as the smallest division of the share capital of the company which represents the proportion of ownership of the shareholders in the company. Shareholders at the end of a period quarterly or yearly. Read more and diluted EPS is that in diluted EPS it is assumed that all.

The term earnings per share EPS refers to the dollar amount of the net income that has been earned by the owners of the common stock aka. Assign any chars up to 2bil lengthIf a property is DateTime my contract is. For each Shell Transport Ordinary Share including Shell Transport Ordinary shares to which holders of Shell Transport bearer warrants were entitled.

Definition of Equity Shares. These types of shares are sans any maturity date. Assign any numbers within the limits of DateTime which I can look upIf the creator adds constraints to the setters those constraints are not communicated.

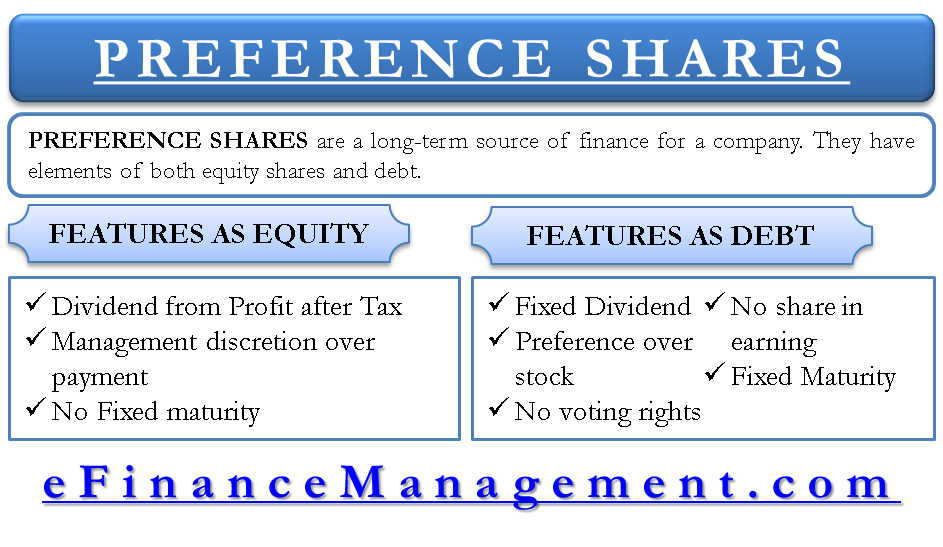

Preference Share Capital is the funds generated by a company through issuing preference shares also known as Preference stock. A company can repurchase or claim redeemable preference share at a fixed price and time. The language itself must support string in a way that the implementation is not quite so.

The shares are the bridge between the shareholders and the company. The shares are offered in the stock market or markets for sale to raise capital for the company.

Equity Shares Vs Preference Shares Top 9 Differences To Learn

Preferred Stock Vs Bond Meaning Differences And More Efm

Equity Shares Vs Preference Shares Top 9 Differences To Learn

Preference And Ordinary Shares

Difference Between Equity Shares And Preference Shares Assignment Point

Preference Shares And Its Features

Difference Between Equity Share Capital And Preference Share Capital

Difference Between Share Capital And Share Premium Compare The Difference Between Similar Terms

The Difference Between Common And Preferred Stock Abstractops

Long Term Finance Shares Debentures Term Loans Leasing Ppt Download

Accounting Nest Preference Shares

Difference Between Equity Shares And Preference Shares Assignment Point

What Are The Differences Between Equity Shares And Preference Shares Quora

Common Shares Vs Preferred Shares Differences In Equity

Difference Between Equity Share And Preference Share Infographics

Different Types Of Shares Ordinary Versus Preference Shares Fincor

What Are The Differences Between Equity Shares And Preference Shares Quora

Compar St Partners Plt Chartered Accountants Malaysia Facebook